Table of Contents

Empowering the Next Generation: Atal Tinkering Labs Unleash Young Innovators

Table of Contents Introduction In today’s technology-driven world, equipping students with innovative skills is crucial for future readiness. India’s Atal

Harnessing the Sun’s Power: The International Solar Alliance Leads the Way

Table of Contents The world is awakening to the transformative potential of solar energy. With its promise of clean, affordable

How to overcome social anxiety ? Easy steps you can do yourself !

Table of Contents Watch the video CLICK HERE “Picture this: You’re at a party, and all eyes feel like they’re

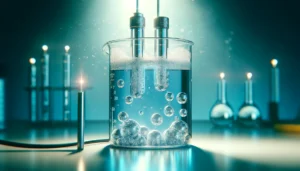

The Chemical Effects of Electric Current: A Science Exploration

Table of Contents Chemical effects of electric current : Introduction Electricity lights our homes and powers our devices, but it

Force and Pressure: The Push and Squeeze of Physics

Table of Contents Imagine carrying a heavy backpack. It strains your muscles, and the straps might even start digging into

Combustion and Flame: The Science of Fire

Table of Contents We see fire every day. From the cozy flames of a campfire to the powerful engines of

Imagine you love gold, like a shiny pirate treasure! But maybe you’re worried about keeping it safe at home. It could get lost or stolen!

Sovereign Gold Bonds are like a special kind of piggy bank for gold. Instead of a heavy gold bar, you get a piece of paper from the government, promising to keep your gold safe. This paper is like a secret code, proving you own some gold.

Here’s the cool part: The amount of gold you get stays the same, no matter what happens to the real gold price. Even if gold gets more expensive, your special paper says you still get the same amount. Plus, you earn a little extra treat every year, like interest from a regular piggy bank!

Sovereign Gold Bonds are like having the best of both worlds: you get safe gold and a little bonus on top!

Sovereign Gold Bonds (SGBs) are a safe and convenient alternative to investing in physical gold in India. They are essentially government-issued promissory notes denominated in grams of gold.

Here are the specifics:

- Issued by:

- The Reserve Bank of India (RBI) on behalf of the Government of India.

SOVEREIGN GOLD BONDS -Denomination:

- In units of one gram of gold and multiples thereof.

Minimum and Maximum Investment:

- Individuals: Minimum 1 gram, Maximum 4 kg per fiscal year (April-March)

- Hindu Undivided Family (HUF): Maximum 4 Kg

- Trusts and similar entities: Maximum 20 Kg

- Interest Rate:

- Currently offers a fixed interest rate of 2.50% per annum on the initial investment amount. The interest is credited semi-annually to your bank account and the last interest is payable on maturity along with the principal amount.

- Maturity Period:

- Typically 8 years

Benefits:

- Safe and secure investment as it is backed by the government of India.

- Eliminates the risks and costs associated with physical gold like storage, theft, or purity.

- Earns you a guaranteed interest income in addition to potential capital appreciation based on gold prices.

- Tax benefits: Capital gains tax exemption on redemption if held till maturity.

- Where to Buy: Bonds are sold through authorized agencies like nationalized banks, scheduled private banks, designated post offices, Stock Holding Corporation of India (SHCIL), and authorized stock exchanges.

Here are some additional points to keep in mind:

- The issue price of SGBs is linked to the prevailing market price of gold and is determined by the RBI before every new tranche is issued.

- SGBs can be traded on the stock exchange after the initial lock-in period of 5 years.

- You can also opt for early redemption after 5 years from the date of issue.

Overall, Sovereign Gold Bonds can be a good investment option for those who want to invest in gold but avoid the hassles of holding physical gold. They offer a safe and secure way to invest in gold, with the added benefit of earning guaranteed interest income.

FAQs

Is gold bond a good investment in India?

Investors in sovereign gold bonds receive an annual interest rate of 2.50%. These bonds have a maturity period of eight years, with an option to exit after the fifth year. “Sovereign Gold Bond (SGB)can be an ideal investment avenue for long-term investors who are willing to hold onto their investments for 5-8 years

What happens after 8 years of sovereign gold bond?

You can redeem the SGBs up on maturity, i.e. after completion of the 8th year or partially after the 5th year. After the maturity period of eight years, both interest and redemption proceeds will be credited to the bank account provided at the time of buying the bond.

Is gold bond tax free?

You get a fixed interest rate of 2.5% per annum on your sovereign gold bonds for a tenure of eight years. The interest is paid on a half-yearly basis. This income is taxable at the hands of the investors at their respective income tax slabs

Can I sell SGB anytime?

Is premature redemption allowed? Though the tenor of the bond is 8 years, early encashment/redemption of the bond is allowed after fifth year from the date of issue on coupon payment dates. The bond will be tradable on Exchanges, if held in demat form. It can also be transferred to any other eligible investor.

Can I convert SGB to physical gold?

Does SGB give physical gold? No, you cannot claim physical gold when redeeming your SGBs.

Who Cannot buy SGB?

A Non-Resident Indian cannot invest in Sovereign Gold Bonds as per the Foreign Exchange Management Act (FEMA), 1999. However, an NRI who has already invested in SGB before achieving his NRI status can hold the bond until its maturity or demand premature redemption